UCR School of Business Assistant Professor of Marketing Margaret Campbell was asked to provide expert insights on Budgeting for an article recently published on WalletHub.

Should every Costco member with a good enough credit score get the Costco Credit Card?

The Costco Credit Card is a good card with no fee for Costco members and has lots of benefits, so this is a good option for Costco members. That said, I would never say that every Costco member should get one because of individual circumstances. Some people who struggle managing credit often find that only using cash is a good self-control mechanism that helps them avoid falling into a credit debt trap. However, if you are already a Costco member and you regularly make purchases there, the benefits can be quite nice.

Do you have any advice for people trying to figure out whether a card like Costco Credit Card is right for them?

Whenever thinking about getting a new credit card people should think hard about their financial situation and their personal self-control around debt. Think about whether adding this card to your existing situation will make it harder to manage your financial situation, for example, because of different due dates, etc. Think about whether you want the “hard inquiry” on your credit report. Think about whether the benefits are right for you. If you spend a lot at Costco in particular think about how that could add up — plus purchases elsewhere.

What do you think is the most underrated benefit that the Costco Credit Card offers?

I do not know the statistics on what people use, but the bundle of travel benefits are quite good and may be overlooked.

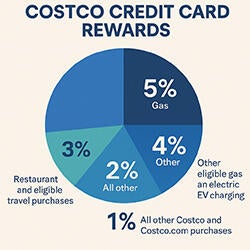

Costco Credit Card Rewards

The Costco Credit Card is an excellent rewards card offering 5% cash back rewards on gas at Costco and 4% cash back on other eligible gas and electric vehicle (EV) charging purchases for the first $7,000 combined spend per year, and then 1% thereafter, 3% back on restaurant and eligible travel purchases, 2% back on all other Costco and Costco.com purchases, and 1% back on all other purchases. Unlike some rewards cards, it doesn’t give any sort of initial bonus, but its regular earning rates still make the card worth getting.

Key Things to Know About Costco Credit Card Rewards

- No limit: There is no maximum amount of cash back you can earn.

- Expiration: Each February, you get a rewards certificate for all of the previous year’s rewards. This certificate is valid through December 31 of the year in which it is issued.

- Redemption options: There are no redemption options other than a Costco rewards certificate, which you must redeem in person.

Costco Credit Card Low Fees

$0 Annual Fee

Despite the fact that it offers generous rewards, the Costco Credit Card costs $0 to own. However, the card requires you to have a Costco membership for approval, which will cost you at least $65 per year

0% Foreign Transaction Fee

The card doesn’t charge you extra for making purchases from merchants in foreign countries, which means it’s good for traveling abroad or making online purchases from foreign companies.

Costco Credit Card Travel Benefits

Travel Insurance

Travel Accident Insurance: This benefit reimburses you up to $250,000 per person for death or serious permanent injury that happens in transit on a trip paid for using your card.

You can learn more about this benefit and other cards that have it from WalletHub’s travel insurance study.

Rental Car Insurance

When you rent a car using your card, this benefit can reimburse you up to $50,000 for collision damage or theft. In order to receive this coverage, you must decline any insurance that the rental car company offers.

You can learn more about this card’s rental car coverage, as well as the best cards that offer rental car insurance, here on WalletHub.

Travel and Emergency Assistance

You can call 1-866-918-4670 in the U.S. or 1-312-356-7839 internationally to reach a 24/7 travel help line. This line can assist you with things like:

- Emergency travel arrangements

- Emergency deliveries of cash

- Information on places you’re traveling to, such as whether they require a visa

- Locating lost luggage

- Medical and legal referrals

- Replacing prescriptions while traveling

- Medical transportation

Roadside Assistance Dispatch Service

If you have car trouble, you can call 1-866-918-4670 to access roadside assistance. This is a paid benefit, but you only pay for the individual services that you use, not to call the help line itself. Roadside assistance can provide:

- Towing and winching

- Jump starts

- Flat tire changes (if you have a spare)

- Lock-out service

- Delivery of up to 2 gallons of gas

For full coverage details, you can refer to the Guide to Benefits provided after account opening or call the number on the back of your card for assistance.

Costco Credit Card Shopping Benefits

Citi Entertainment

This card gives you access to Citi Entertainment, which allows you to buy presale tickets for various events and purchase cardholder-exclusive experiences.

Tap to Pay

This card supports tap to pay technology, which is quicker and more secure than inserting a chip into a card reader.

Digital Wallets

You can add this card to digital wallets such as Apple Pay, Google Pay or Samsung Pay in order to easily make purchases online without having to type in your details every time.

Costco Credit Card Protection Benefits

Damage & Theft Purchase Protection

Damage & Theft Purchase Protection may cover you for repairs or a refund if purchases made with your Citi card are damaged or stolen within 120 days of purchase (90 days for New York residents). The coverage amount is up to $1,000 per item and $50,000 per year.

For full coverage details, you can refer to the Guide to Benefits provided after account opening or call the number on the back of your card for assistance.

Zero Fraud Liability

You have $0 liability for any fraudulent purchases on the card, as long as you report them. This is standard on all major credit cards.

Fraud Alerts

Citibank will monitor your account and send you a message if it detects any suspicious activity.

Other Costco Credit Card Benefits

Membership Card

Your Costco Credit Card also functions as your Costco membership card, so you don’t have to carry a separate membership card around in your wallet.

Credit Building

The Costco Credit Card will report information such as your balance and payment history to all three major credit bureaus – Equifax, Experian, and TransUnion – each month. As long as you use your card in a responsible manner, paying on time and keeping your credit utilization low, you will be able to raise your credit score (or keep it high).

____________________________________

All images courtesy of ChatGPT